Toronto Housing Market Stability in August as Listings Continue to Rise

Toronto’s housing market is finding its balance as listings rise, offering both opportunities and challenges for buyers and sellers. August 2024 saw a notable increase in the number of homes for sale, which has shifted market dynamics across the Greater Toronto Area (GTA). Let's explore what this means for property prices, buyer behavior, and the future of real estate in the city.

Stability in the Toronto Housing Market

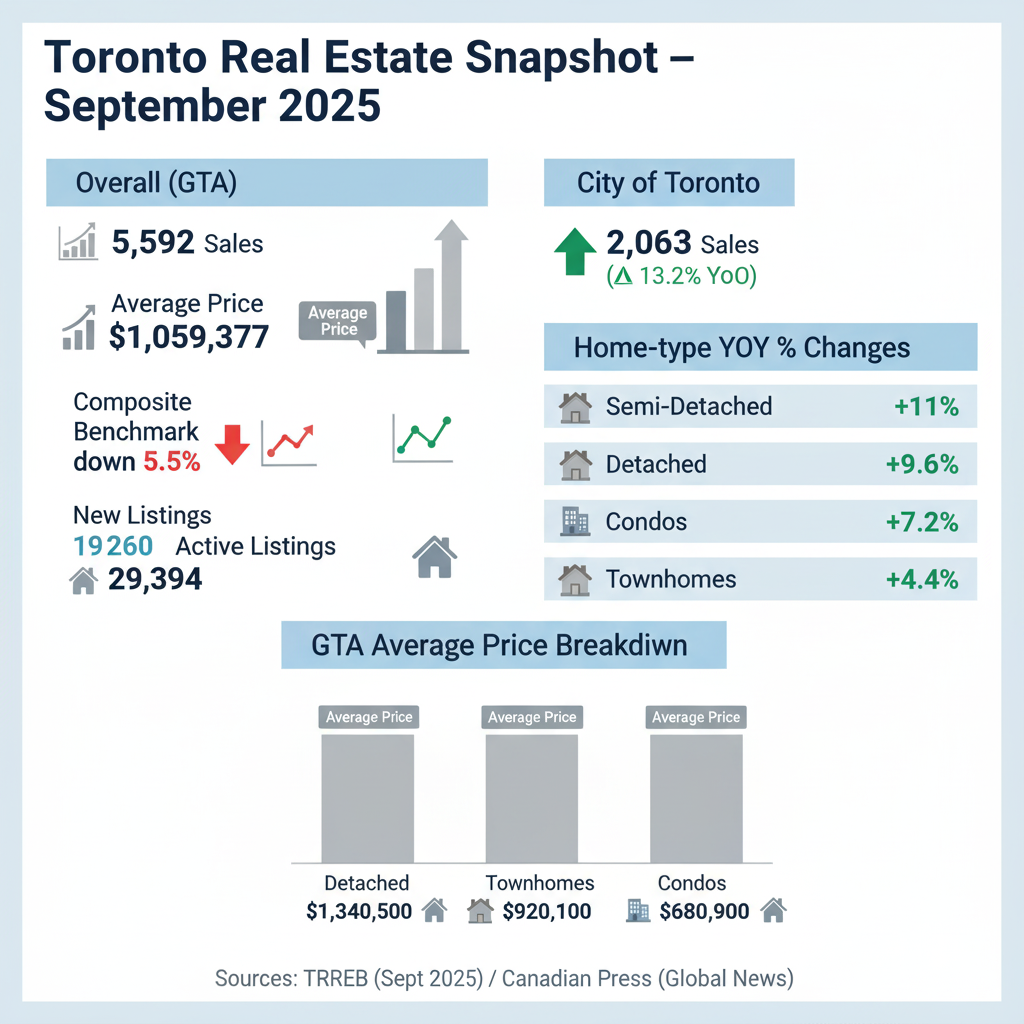

The Toronto housing market has largely stabilized despite facing some challenges. In August 2024, the average home price across the GTA dropped slightly to USD 1,074,425—a mere 0.7% decrease from last year. Detached homes, the most resilient segment, experienced just a minor price drop of 0.2%, holding steady at an average of USD 1.41M.

However, semi-detached homes and freehold townhouses saw more significant declines, with prices down by 3.9% and 3.1%, respectively. Condo apartments were the hardest hit, with prices dropping 4.4%, averaging USD 675,000.

Despite these fluctuations, the market is showing early signs of a rebound, with increased showings and rising sales, particularly in detached and townhomes. Lower interest rates could soon encourage even more buyer activity.

Listings on the Rise: What It Means for Buyers and Sellers

Toronto's housing market saw a 1.5% rise in new listings this August, with 12,547 properties joining the market. Condos led the surge, with a 21% increase in available units compared to last year. This influx has given buyers more options, particularly in the condo market, where oversupply is exerting downward pressure on prices.

But what does this mean in the long run? The increase in supply, especially in the condo sector, has led to more competitive pricing. While this presents opportunities for buyers, particularly those looking for condos, the market still faces challenges absorbing the surplus inventory. As interest rates potentially fall in the coming months, buyers could benefit from both lower prices and lower borrowing costs.

Property Price Trends: A Closer Look

Different property types in the Toronto housing market are seeing varied price trends:

- Detached Homes: Slight 0.2% price drop, averaging USD 1.41M.

- Semi-Detached Homes: Prices down 3.9%, averaging USD 1,026,435.

- Freehold Townhouses: Prices decreased by 3.1%, now averaging USD 991,307.

- Condo Apartments: The largest decline, with prices dropping 4.4% to USD 675,000.

Condo prices, in particular, continue to be a concern due to oversupply and the upcoming completion of new developments. That said, these lower prices could be a great entry point for buyers looking for a good deal in the city.

The Impact of Interest Rates

Interest rates are playing a pivotal role in shaping the Toronto housing market. Although the Bank of Canada has reduced rates three times, bringing the key lending rate to 4.25%, the effect on the market has been slower than expected. Mortgage rates remain relatively high, with the lowest five-year fixed rate at 4.34% and variable rates hovering around 5.4%.

This has led to a bit of a standstill in the market, with sellers holding firm on their asking prices, while buyers are hesitant to make offers. Experts believe deeper rate cuts may be needed to reduce mortgage costs significantly and spark more demand.

Conclusion

Toronto's housing market is at a turning point, with rising listings offering buyers more options but high interest rates keeping demand in check. While some property types, like detached homes, remain relatively stable, others especially condos are seeing price declines due to oversupply. As interest rates potentially drop in the coming months, this could reignite buyer activity, leading to a more balanced market. The key will be watching how rates and inventory levels evolve as we head into the rest of the year.

Check out our other blogs for more valuable information.

Sources:

Toronto Regional Real Estate Board (TRREB): https://www.trreb.ca/

Bank of Canada: https://www.bankofcanada.ca/

Statistics Canada: https://www.statcan.gc.ca/en/start

Disclaimer: The content above is a compilation from diverse reliable online sources, including blogs and news articles. The Condomonk content team does not ensure the factual accuracy of the information. The provided information may be outdated, and it should not be considered as advice or a recommendation. It is advisable to consult with a licensed real estate agent or broker for accurate advice and recommendations.