A First-Time Homebuyer’s Guide to Calgary’s Real Estate Market

A First-Time Homebuyer’s Guide to Calgary’s Real Estate Market

Buying your first home is exciting, but when it comes to navigating Calgary’s real estate market, things can get a little overwhelming. With fluctuating prices, neighborhood dynamics, and understanding mortgage options, it’s important to walk into the process well-prepared. Lucky for you, this guide will break down all the essential details you need to know as a first-time homebuyer in Calgary. Let’s get started, shall we?

Understanding Calgary’s Real Estate Market

Calgary’s real estate market has experienced a lot of changes over the past few years, and staying on top of current trends is key. With a growing population and strong job market, the demand for homes—especially condos and detached houses—remains high. In fact, condos in Calgary are increasingly popular among first-time homebuyers due to their affordability and lower maintenance. For more detailed listings on condos in the city, check out Calgary Condos.

Here are a few things to keep in mind about Calgary's housing market:

- Affordability: Calgary remains one of Canada’s more affordable major cities compared to Vancouver or Toronto. However, prices can vary greatly depending on the neighborhood and type of property.

- Property Types: Buyers can choose from a variety of housing types in Calgary, including condos, townhomes, and detached houses. If you're exploring different options, take a look at Detached Homes in Calgary or Calgary Townhomes to find what's right for you.

- Market Conditions: Like any real estate market, Calgary’s market fluctuates. Keeping an eye on trends will help you know when to strike, so you don’t miss out on a great deal.

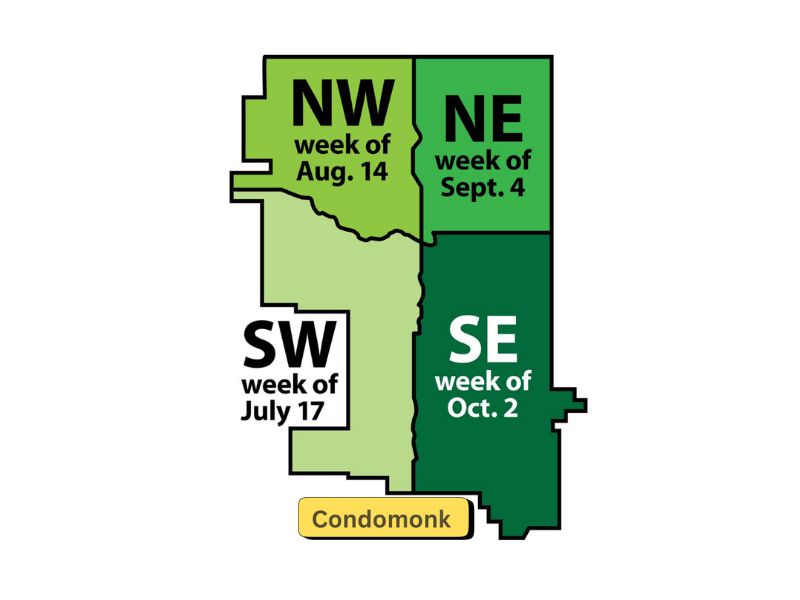

Picking the Right Neighborhood

One of the biggest decisions you'll make as a first-time homebuyer is choosing the right neighborhood. Calgary has a diverse range of areas to suit different lifestyles, budgets, and preferences. Some neighborhoods are known for their bustling downtown vibes, while others offer quiet suburban living.

Here are a few popular areas to consider:

- Beltline – Perfect for young professionals who want to be close to the downtown core. With plenty of high-rise condos, it’s an ideal spot for first-time buyers. Check out some condos available in the Beltline area.

- Bridgeland – Known for its unique blend of modern condos and historic homes, Bridgeland is a favorite for those looking for charm and convenience. Its proximity to downtown and green spaces makes it a popular choice.

- Evanston – A great family-friendly suburb with affordable detached homes. If you’re looking for a more laid-back atmosphere away from the hustle and bustle of downtown, this could be your spot. Curious about detached homes here? Browse Calgary’s Detached Listings.

- Altadore – For those with a bit more budget to spend, Altadore offers a blend of luxury living, close-knit community vibes, and plenty of parks.

Don’t hesitate to spend some time driving through different neighborhoods or checking out open houses to get a feel for what fits your lifestyle.

Preparing Your Finances and Mortgage Options

Getting your finances in order is a major step before even thinking about making an offer. First-time homebuyers in Calgary have several mortgage options, including government-backed incentives, which can help reduce the upfront costs.

Here are some basic steps to get you started:

- Save for a Down Payment: In Canada, the minimum down payment is 5% of the home’s purchase price for properties under $500,000. If the price is higher, you'll need at least 10% of the additional amount above that threshold. Keep in mind that a larger down payment reduces your monthly mortgage payments and interest.

- Get Pre-Approved for a Mortgage: This not only helps you understand your buying power, but it also shows sellers that you’re serious. Consider talking to different banks or mortgage brokers to find the best interest rates and terms.

- First-Time Homebuyer Incentives: You could be eligible for programs like the First-Time Home Buyer Incentive and the Home Buyers' Plan, which allow you to borrow from your RRSP for a down payment. It’s worth looking into these programs to see if you qualify.

For more insight on navigating mortgages and financing, you can consult with a local mortgage advisor who knows the Calgary market well.

Tips for First-Time Homebuyers in Calgary

Now that you have the basics covered, let’s look at a few extra tips that’ll help you through the homebuying process:

- Work with a Local Realtor: A realtor who specializes in Calgary’s real estate market will not only help you find the right property but also guide you through the negotiation and paperwork process. Realtors are invaluable when it comes to spotting good deals and avoiding potential pitfalls.

- Be Realistic About Your Budget: It’s easy to fall in love with a home that’s out of your price range, but sticking to your budget is critical. Calgary has a range of options, and there’s likely a great home out there for you without stretching your finances too thin.

- Do a Home Inspection: Never skip this step! Even if a property seems perfect, a home inspection can reveal hidden issues that could cost you in the long run.

- Consider Future Growth: Calgary is growing, and some neighborhoods will see new developments in the coming years. Keep an eye on areas that are expected to rise in value if you’re thinking long-term investment.

Making Your Offer

So, you’ve found your dream home—what’s next? Making an offer can be one of the most nerve-wracking parts of buying a home, especially as a first-timer.

Here’s a quick rundown of the steps:

- Submit an Offer: Once you’ve found the property you want, your realtor will help you submit an offer. Keep in mind, you’ll likely need to negotiate on the price and other terms.

- Earnest Money Deposit: Be prepared to put down an earnest money deposit to show that you’re serious. This deposit will go toward your down payment if the offer is accepted.

- Offer Acceptance: Once your offer is accepted, you’ll move into the final stages, which include signing papers, securing your mortgage, and closing the deal.

Final Thoughts: You’re Almost Home!

Buying your first home in Calgary is a big decision, but with the right knowledge and resources, you can make the process a lot less daunting. Remember to stay informed about the market, be smart with your finances, and always seek professional advice when needed.

Ready to start exploring your options? Take a look at Calgary’s Real Estate Listings to get a feel for what’s available right now. Whether you’re eyeing condos, detached homes, or townhomes, there’s something for every first-time homebuyer in Calgary!

FAQs

1. What’s the average price of a first home in Calgary? The average price for a first-time homebuyer in Calgary varies depending on the area and property type. Condos can start around $250,000, while detached homes may be priced closer to $500,000 or more.

2. How long does the homebuying process take in Calgary? It can take anywhere from a few weeks to several months. The timeline depends on your personal readiness, market conditions, and how quickly you find a home that meets your needs.

3. Are there any specific first-time buyer programs in Calgary? Yes, several federal programs, such as the First-Time Home Buyer Incentive and the Home Buyers' Plan, offer assistance to first-time homebuyers in Canada, including Calgary.